maine tax rates by town

Monday - Friday 800 am. Maine is ranked number twenty out of the fifty.

Wiscasset Charts New Course In Setting Tax Rate Wiscasset Newspaper

Real Estate Tax Bills Download a copy of your tax bill by clicking the link.

. 27 rows In 1997 44 of the total revenue raised by the states three major tax systems was generated by the property tax. The Property Tax Division is divided into two units. Maine has recent rate changes Wed Jan 01.

This map shows effective 2013 property tax rates for 488 Maine cities and towns. Please contact the Tax Collector if you would like to receive your tax bills electronically. These tax rates are.

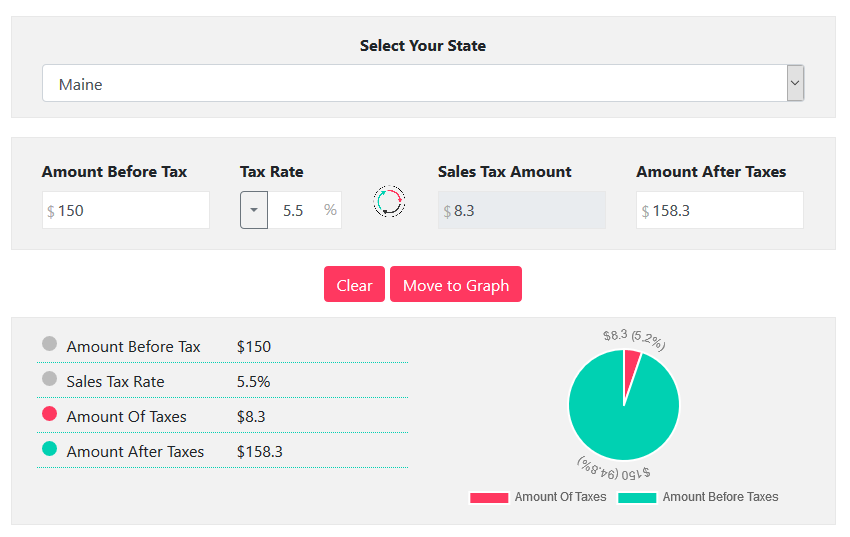

Rates include state county and city taxes. Maine has a 55 sales tax and Washington County collects an additional. 207 967-8470 Town Office Hours.

2021 Municipal Valuation Return. Municipal Services and the Unorganized Territory. The personal and corporate income tax generated 30 of that.

Tax amount varies by county. A wealth of information detailing valuations and exemptions by selected categories assessment ratios and tax rates on a town-by-town basis is compiled. 2022 List of Maine Local Sales Tax Rates.

Lowest sales tax 55 Highest sales tax 55 Maine Sales Tax. Town of Kennebunkport PO Box 566 6 Elm Street Kennebunkport ME 04046 PH. At the median rate the tax bill on a.

There are no local taxes beyond the state rate. The statewide median rate is 1430 for every 1000 of assessed value. The median property tax in Maine is 109 of a propertys assesed fair market value as property tax per year.

Real Estate Tax Bills Download a copy of your tax bill by clicking the link. Full Value Tax Rates Represent Tax per 1000 of Value EAGLE LAKE 1445 1575 1679 1650 1564 1618 1565 1458 1455 1466 EASTON 1595 1685 1754 1726 1737 1739 1521. 499 rows CityTown County 2017 Rate 2010 Rate Growth since 2010.

Please contact the Tax Collector if you would like to receive your tax bills electronically. Maine also has a corporate income tax that ranges from 350 percent to 893 percent. Maine has state sales tax of.

Maine ME Sales Tax Rates by City The state sales tax rate in Maine is 5500. The 55 sales tax rate in Old Town consists of 55 Maine state sales tax. The Property Tax Division prepares a statistical summary of selected municipal information that must be annually reported to MRS by municipal assessing officials.

Rates for years 1990 through 2021 MS Excel Rates for years 1990 through 2021 PDF. Municipalities may by vote determine the rate of interest that shall apply to taxes that become delinquent during a particular taxable year until those taxes are paid in full. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Our division is responsible for the determination of the annual equalized full value. You Can See Data Regarding Taxes Mortgages Liens Much. A wealth of information.

Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent. Full Value Tax Rates Each year Maine Revenue Services determines the full equalized value of each municipality and subsequently calculates a full value tax rate. Average Sales Tax With Local.

Poland Selectpersons Leave Tax Rate Unchanged Poland Me

What Maine Town Has The Lowest Mill Rate Maine Homes By Down East

Franklin County Tax Rate Decreases By One Cent Lewiston Sun Journal

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

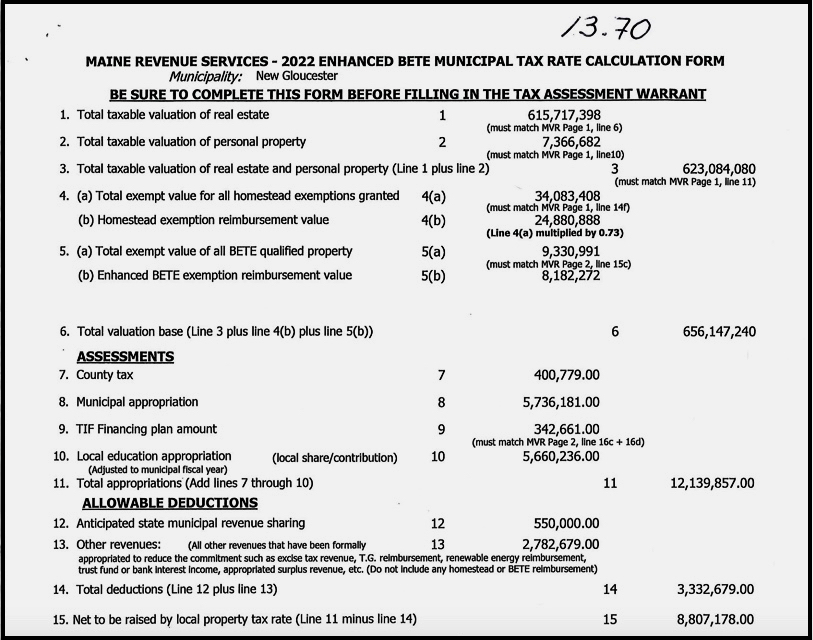

Select Board To Set Fy23 Tax Rate Hear Roads Analysis Upper Village Planning Update Ngxchange

Maine Sales Tax Calculator Reverse Sales Dremployee

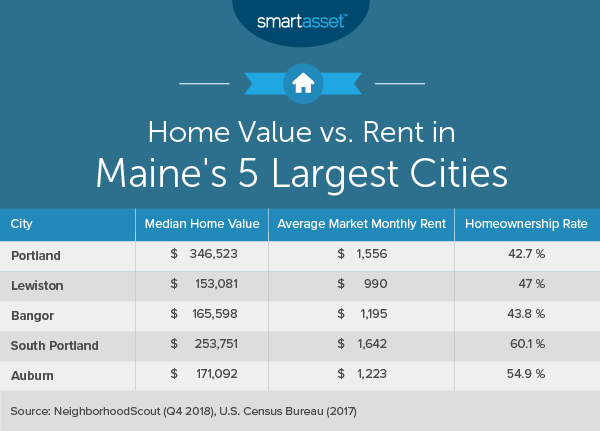

What Is The Cost Of Living In Maine Smartasset

Tax Maps And Valuation Listings Maine Revenue Services

The 30 Towns With The Highest Property Tax Rates In N J Nj Com

Property Taxes Urban Institute

Appleton Tax Rate Increases By 6 Percent Knox County Villagesoup

Local Maine Property Tax Rates Maine Relocation Services

Maine Property Tax Rates By Town The Master List

Maine Property Tax Rates By Town The Master List

News Town Of Scarborough Maine

How Do Marijuana Taxes Work Tax Policy Center